8:00 - 9:00

Mon - Fri

Alternative investments provide opportunities beyond traditional asset classes, often exhibiting low correlation with stock and bond markets. They can enhance portfolio diversification and potentially improve returns. More and more investors are shifting to alternatives to boost returns, generate income, provide diversification from traditional investments and achieve their goals.

1. Private Equity: Investments in private companies or buyouts of public companies.

2. Hedge Funds: Pooled investments utilizing various strategies to achieve high returns.

3. Commodities: Physical goods like gold, oil, and agricultural products that can hedge against

inflation.

4. Cryptocurrencies: Digital currencies offering high volatility and potential returns.

5. Collectibles: Tangible assets like art, wine, and rare coins that can appreciate over time.

Our 330-plus alternative investment professionals supplement their networks and know-how with insights from GS Fund Holding’s other 2,000-plus investors around the world.

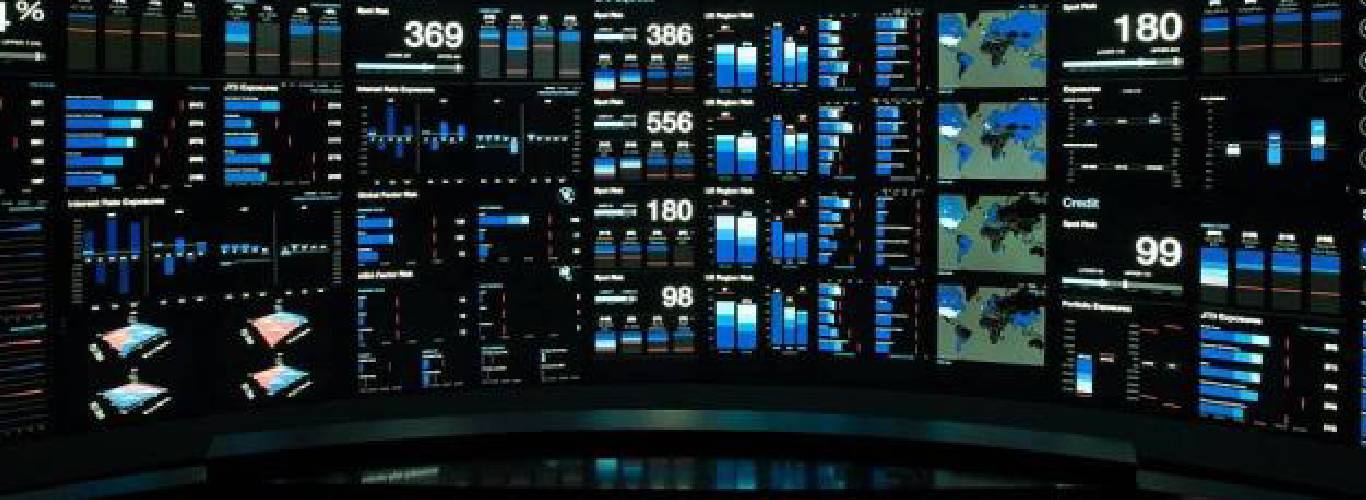

We use advanced technology to help build stronger portfolios – we monitor 3,000 risk factors daily and 45,000 private companies on eFront.

We can fully model the whole portfolio to ensure you have a deeper understanding of how alternatives impact the rest of your portfolio.

Our 1,000+ member professional staff works to understand investor needs– and deliver BlackRock’s best use of skill, scale and technology to help you achieve your goals.